Revelio Labs & KPMG Collaboration: Do SPACs Leave Their Employees in the Dust?

In collaboration with KPMG, we compare the employment and sentiment impact of SPACs to traditional IPOs...

Taking a company public can be a long and arduous process. Yet an increasing number of companies have opted to expedite this by using Special Purpose Acquisition Companies (SPACs). SPACs can take only a few months to execute, instead of the usual 12-18 of an IPO. And they have soared in popularity over the last few years, with their share in the total number of IPOs increasing from almost a quarter in 2019 to over half in 2021. But what effects does this speed have on a company’s workforce, specifically around growth and employee well being?

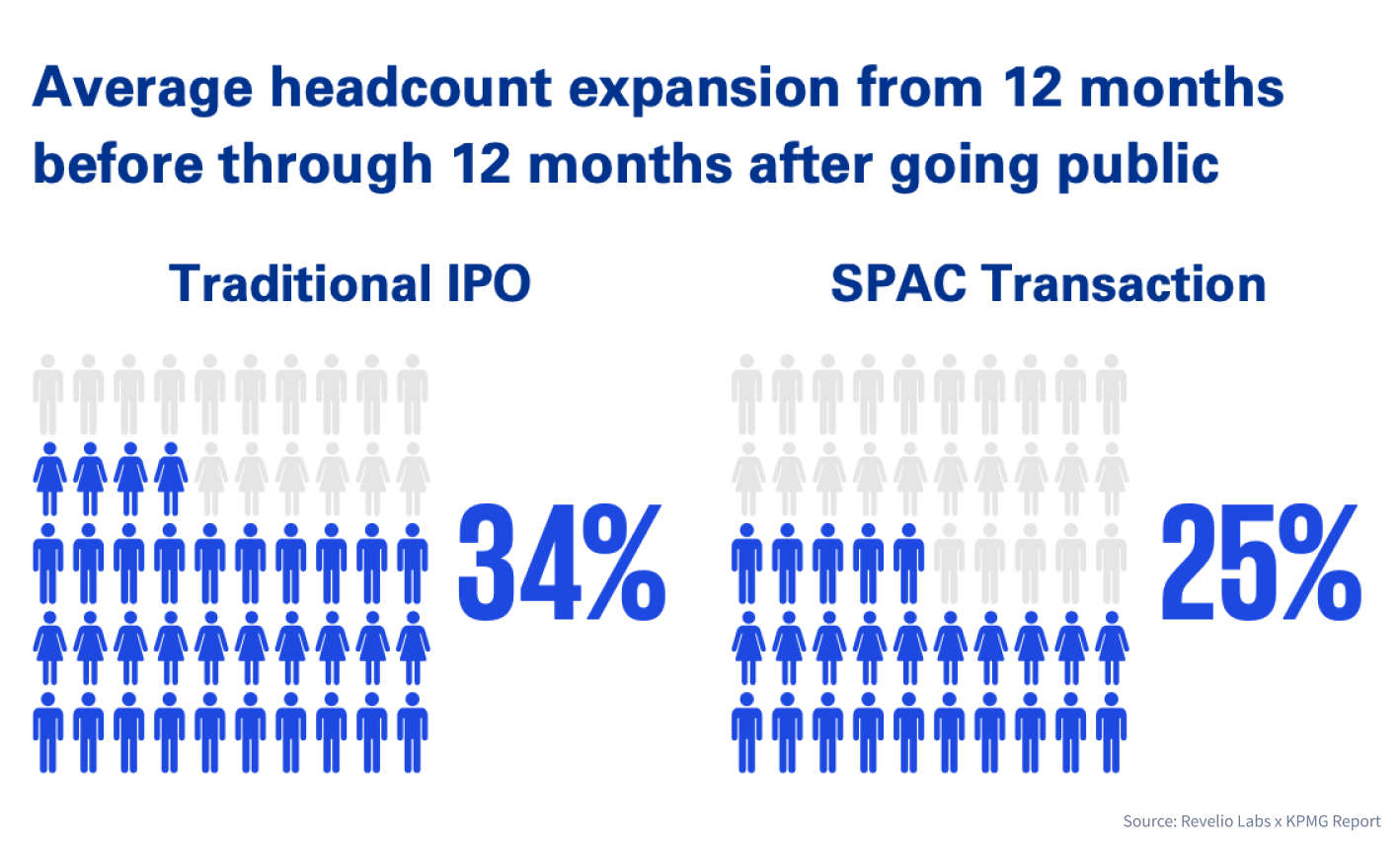

In collaboration with KPMG, we compare the employment and sentiment impact of SPACs to traditional IPOs. On average, IPO companies increase their headcount by 9 percentage points more than SPAC companies. IPO employment growth is also higher and steadier throughout the whole process, according to our labor market analysis.

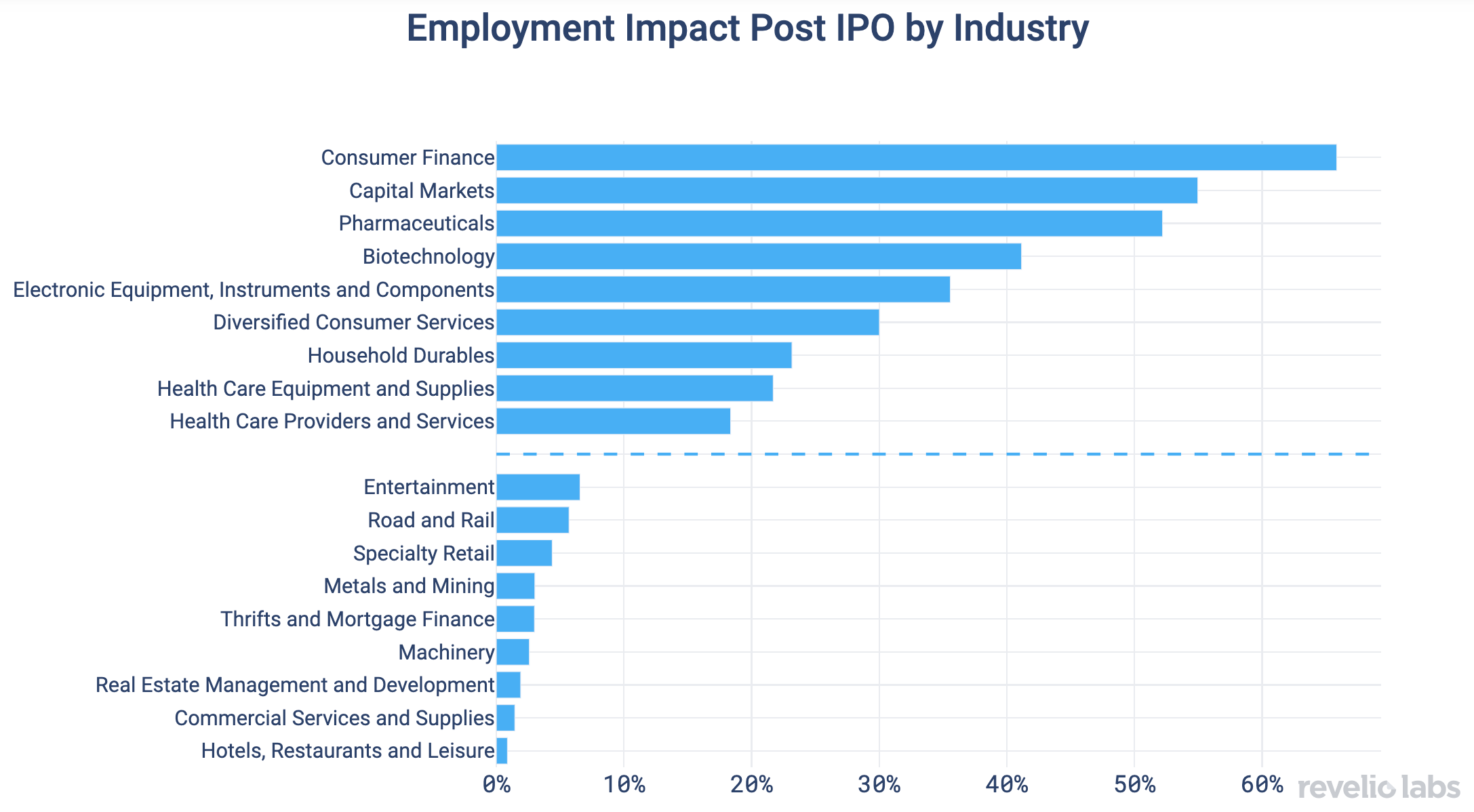

Headcount growth problems can hinder companies’ abilities to expand their Legal, Accounting, and Compliance teams, which are all necessary to meet the demands of the public markets. This specialist growth is particularly crucial for those trying to go public in highly regulated industries like Consumer Finance, Capital Markets, and Health Products.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

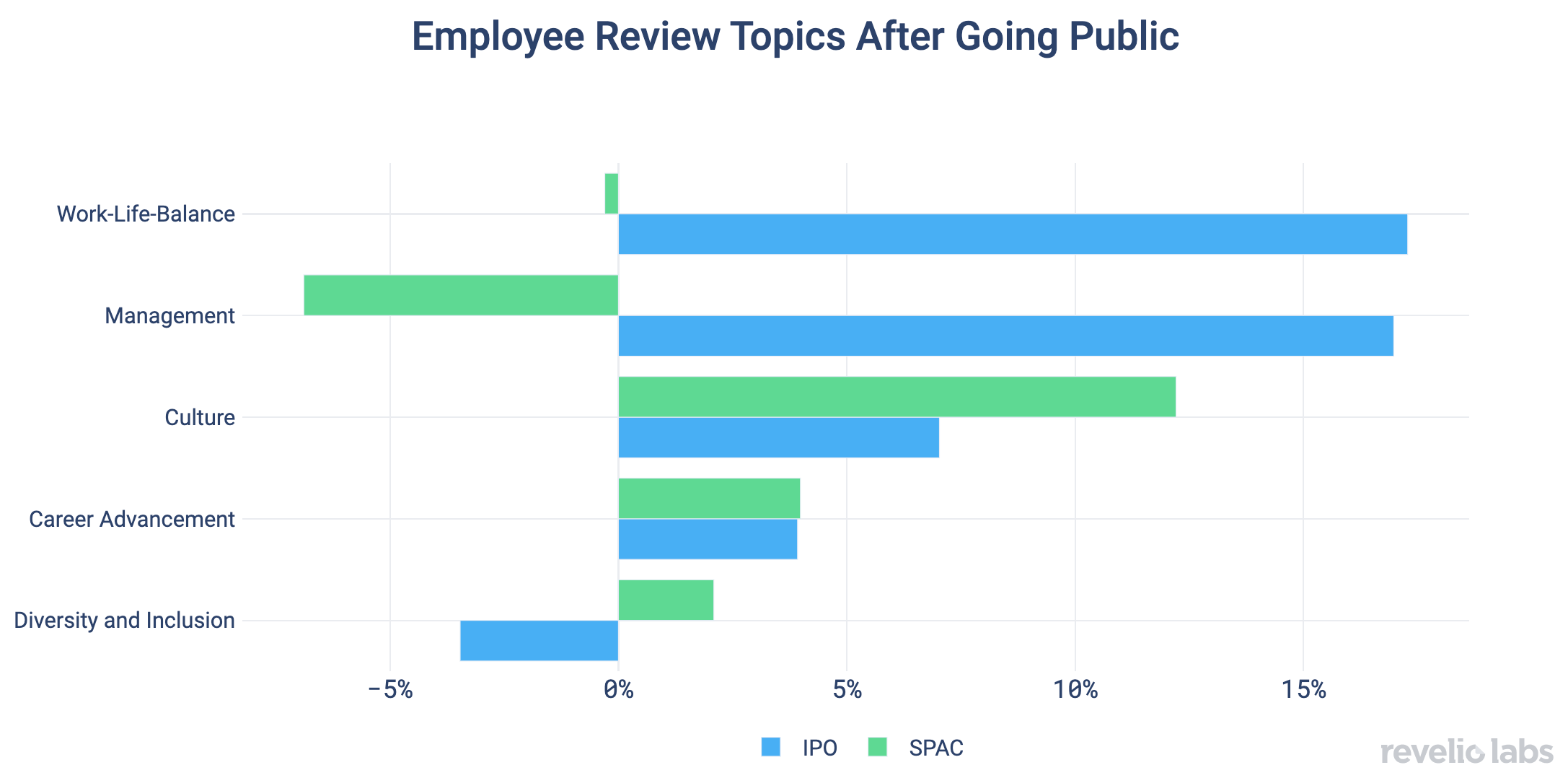

Further, rushing into the market through a SPAC can leave employees unenthused about what should be a momentous step forward for the company, according to Revelio Labs sentiment data. While employee sentiment increases over 15 percent in the months following a traditional IPO, sentiment stagnates after SPACs.

By comparing the positive and negative topics mentioned by employees in IPO versus SPAC firms in the year following the event, we see that the lower employment growth is most attributable to frustration around Management and Work-Life balance.

Key Takeaways:

- SPAC companies lag behind classic IPO companies in terms of hiring for Legal, Accounting and Compliance professionals in preparation for the event.

- While SPACs can be an excellent means of hitting the market quickly, hasty preparation for the event can hinder company growth, and leave valuable employees ambivalent on the state of the company.

- Read the full Revelio & KPMG Report here for more details on our labor market analysis.